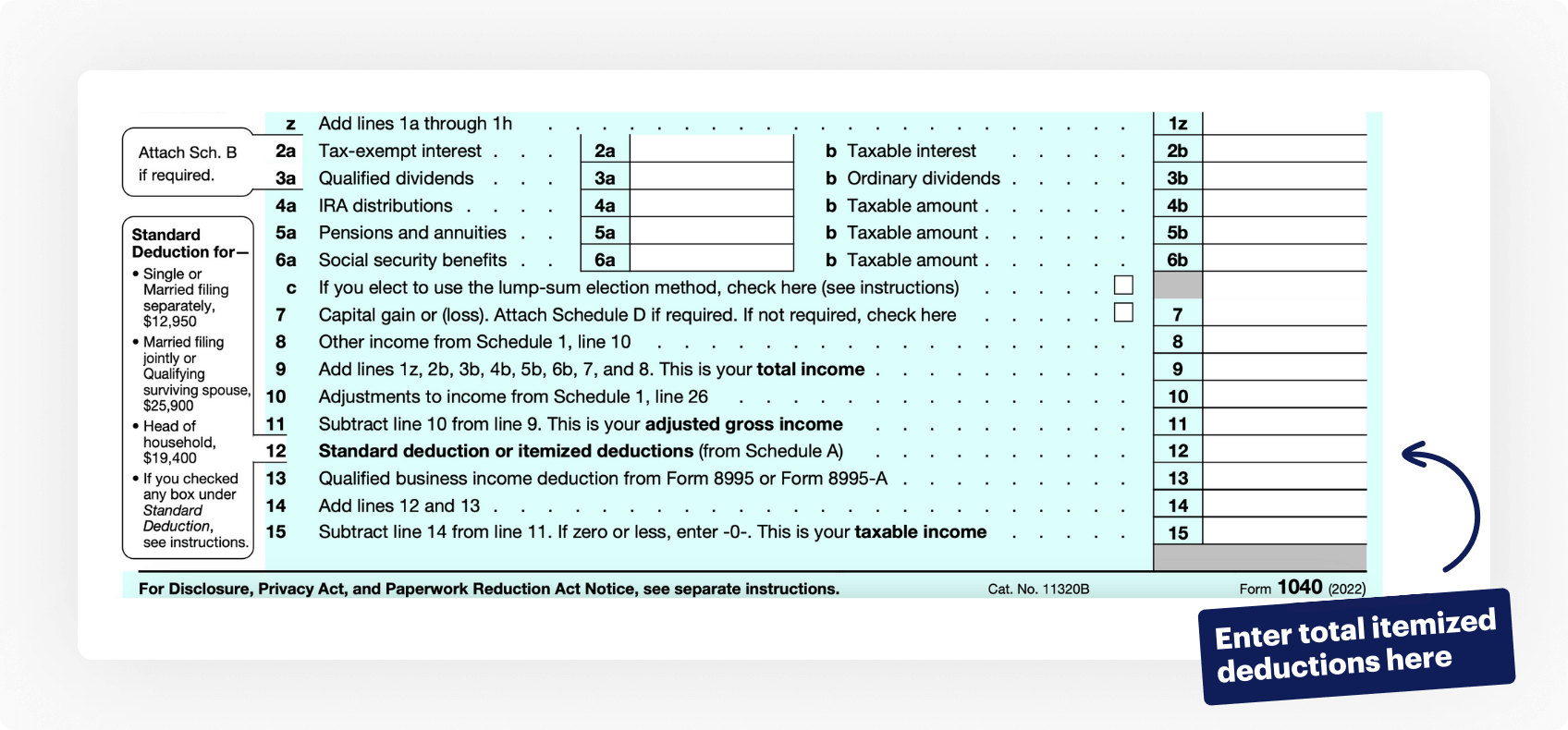

2024 Itemized Deductions Schedule A Form 1040 – Additionally, the IRS adjusted its standard deduction for 2024. That allows for households to deduct more of their expenses from qualified deductions (such as mortgage insurance, charitable . Here are the standard deductions by filing status for the 2023 and 2024 as itemized deductions, then you will need to complete the information on Schedule A of your 1040 form. .

2024 Itemized Deductions Schedule A Form 1040

Source : www.investopedia.com

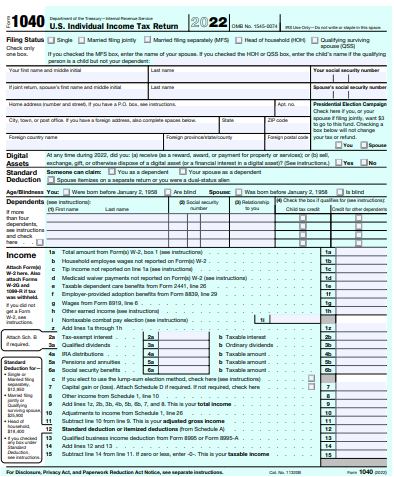

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

1040 Schedule A Instructions: Reduce Taxes with Itemized

Source : blog.pdffiller.com

Schedule A (Form 1040) Guide 2023 | US Expat Tax Service

Source : www.taxesforexpats.com

1040 Schedule A Instructions: Reduce Taxes with Itemized

Source : blog.pdffiller.com

Schedule A (Form 1040) Itemized Deductions Guide NerdWallet

Source : www.nerdwallet.com

What is IRS Form 1040 Schedule 5? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What Are Itemized Tax Deductions? Definition and Impact on Taxes

Source : www.investopedia.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

2024 Itemized Deductions Schedule A Form 1040 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: For 2024, the maximum HSA contribution for somebody with and for married people filing separately. The difference between deductions and credits, Itemized deductions vs. the standard deduction, . Standard deduction: 2023 and 2024 The amount of the standard you’ll claim it on Form 1040. For itemized deductions, you’ll need Schedule A to list all of the eligible expenses you’re claiming. .

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)

:max_bytes(150000):strip_icc()/2023ScheduleAForm1040-0009d925813b4663868b1112927363f5.png)